Becoming a THDA-approved REALTOR®

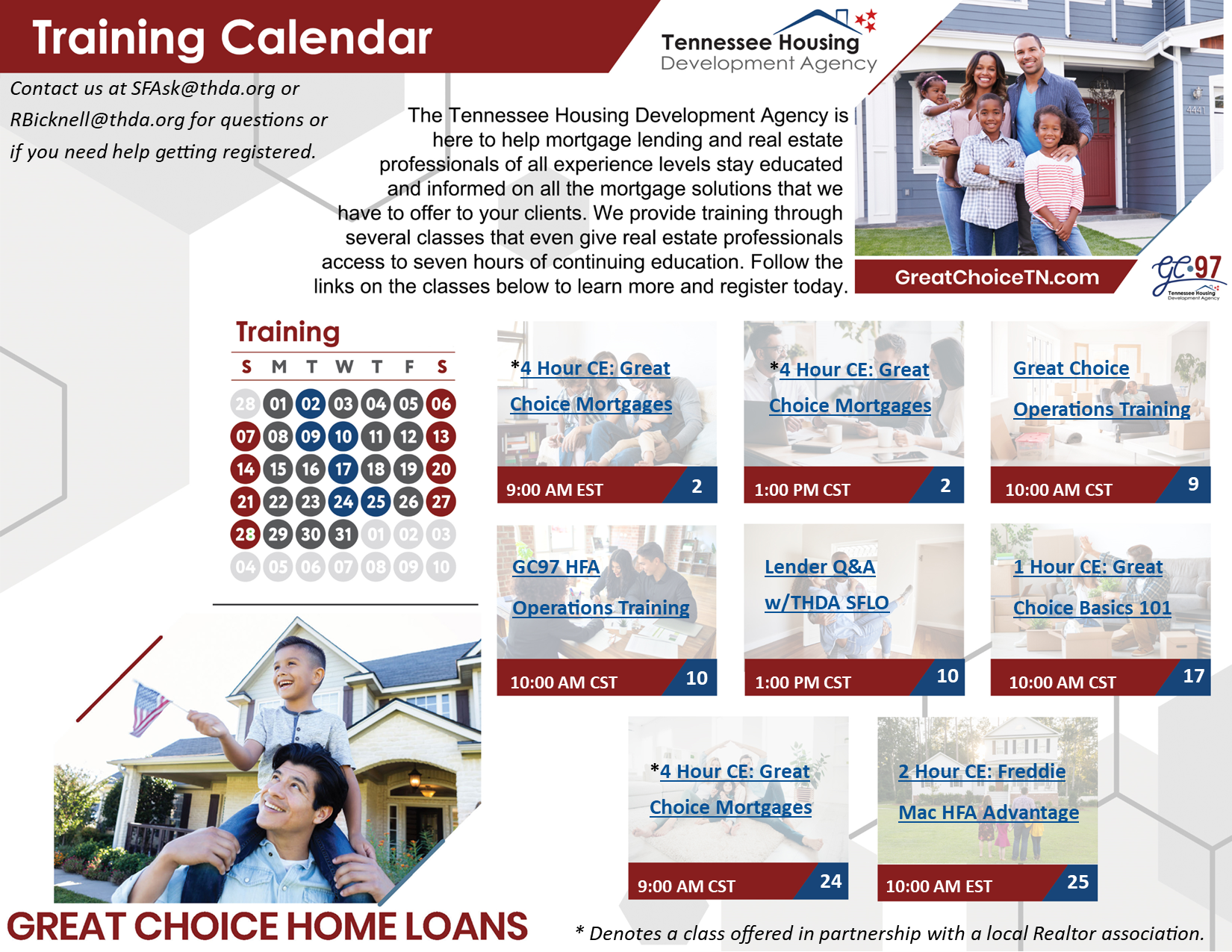

To become a THDA-approved REALTOR® and have your contact information shown in THDA’s Find a REALTOR® page, you must register for and take the TREC-approved, 4-hour continuing education class offered through your REALTOR® association.

TREC Class Name and Number: THDA “Great Choice Mortgage Programs” – Course #7571

If the class is not shown on the upcoming education schedule through your association, you may check with the next closest association to see if the THDA Course 7571 is offered and take the class there. You may also ask your association’s education manager to contact Josh McKinney to schedule a class for members of your association.

Great Choice Loan Program Advantages

Learn more about how THDA’s Great Choice Loan Program can help your buyers!

Criteria for THDA’s Great Choice Loan Program

Your knowledge of THDA requirements may allow mortgage loan transactions to close with THDA as the investor.

- First-Time Home Buyer or Eligible Repeat Homebuyer (Click here to see the targeted areas)

- Mortgage Revenue Bond Income Limits

- Acquisition Cost limits

- Single Family residence

- Owner-occupied property

- 640 Minimum Credit Score

- 43-45% Debt-to-Income (43% manual underwrite – 45% DU/LP underwrite & automated underwrite)

Freddie Mac HFA Advantage® Loan Program

Learn more about the Freddie Mac HFA Advantage® Program, offering a conventional mortgage loan with the options of down payment and closing cost assistance.

If your clients have questions regarding servicing of their THDA loans, they can contact Volunteer Mortgage Loan Servicing.